Streamline cybersecurity and demonstrate compliance with banking regulations.

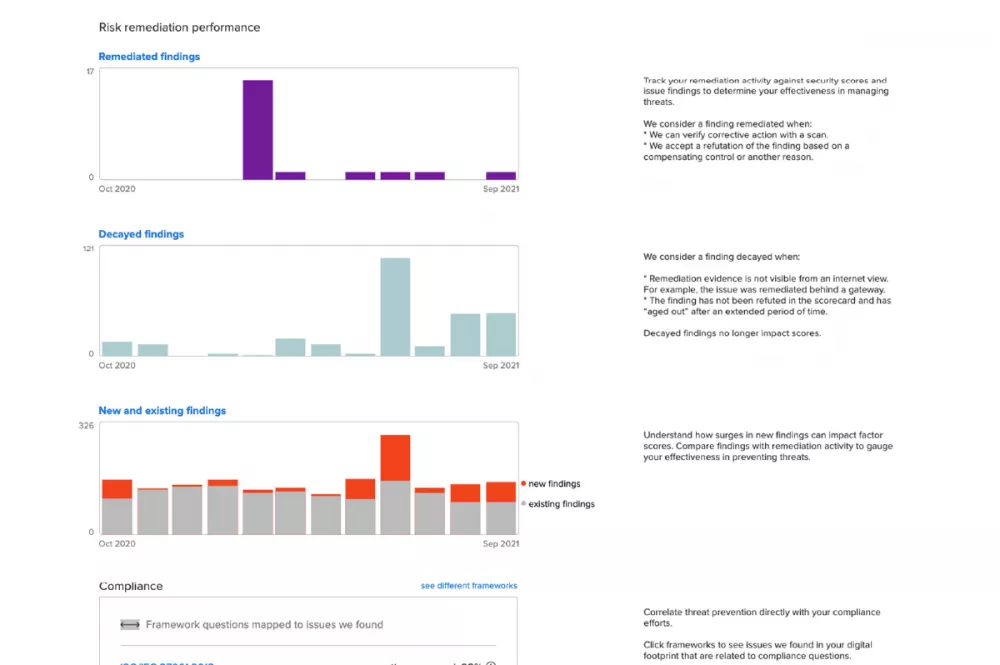

Remediate vulnerabilities that expose you to attack and noncompliance. Use your security posture as a differentiator to build trust among customers and investors.

Monitor third-party risk

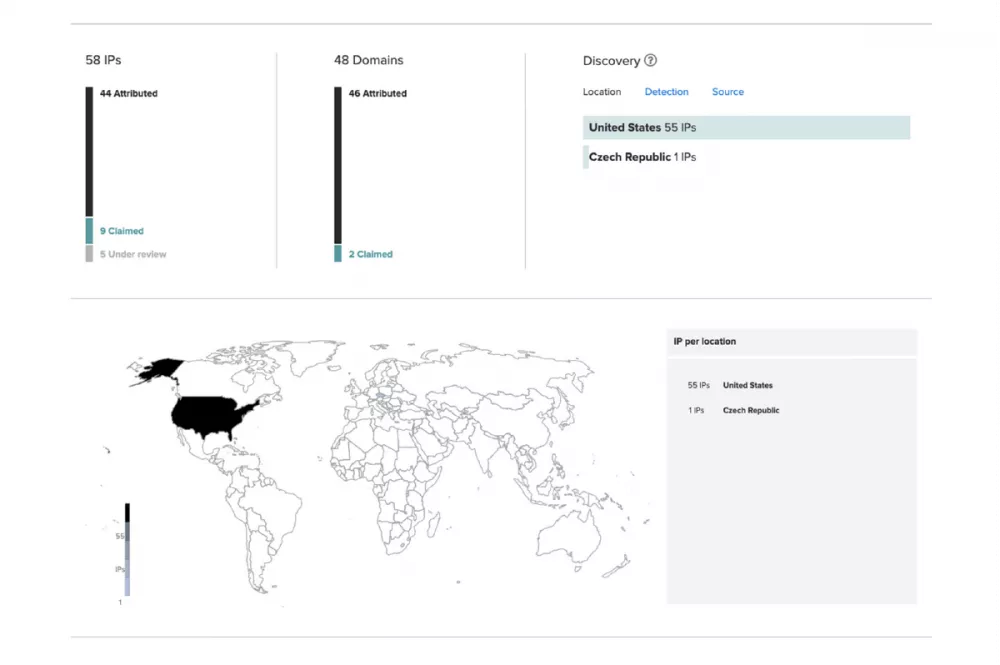

Understand aggregate cyber risk across your vendor portfolio and drill down to remediate vulnerabilities before they impact you and your customers’ data.

Demonstrate compliance

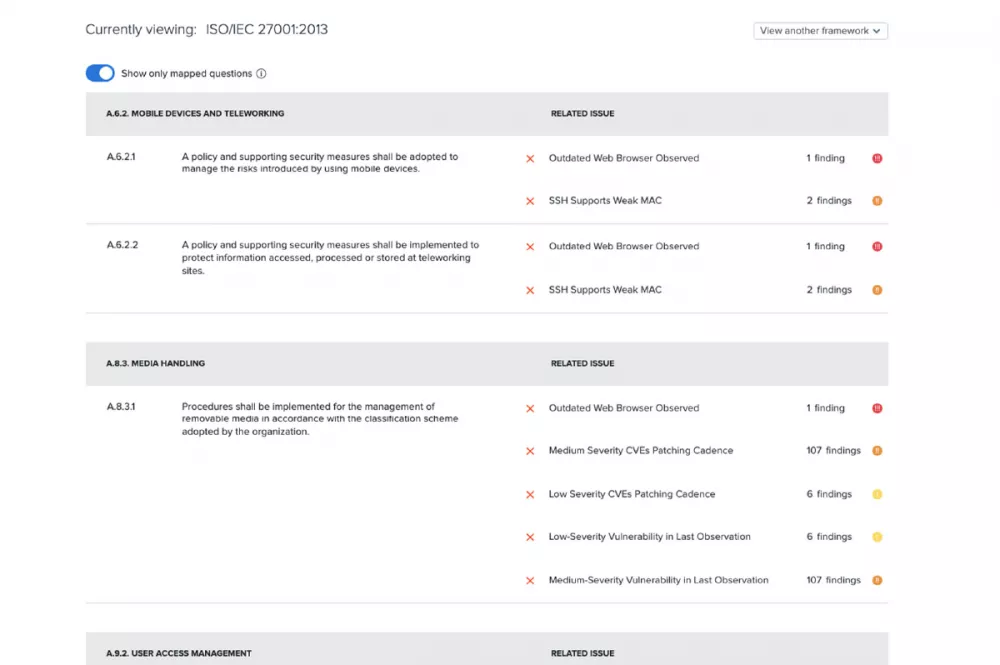

Track adherence to regulatory frameworks and show your customers and investors that you’re following industry guidelines to protect their information and investments.

Remain competitive

Know how you stack up against the competition. Access up-to-date comparative data so you can benchmark your organization’s performance over time and report on program success to senior leadership.

Optimize assessments

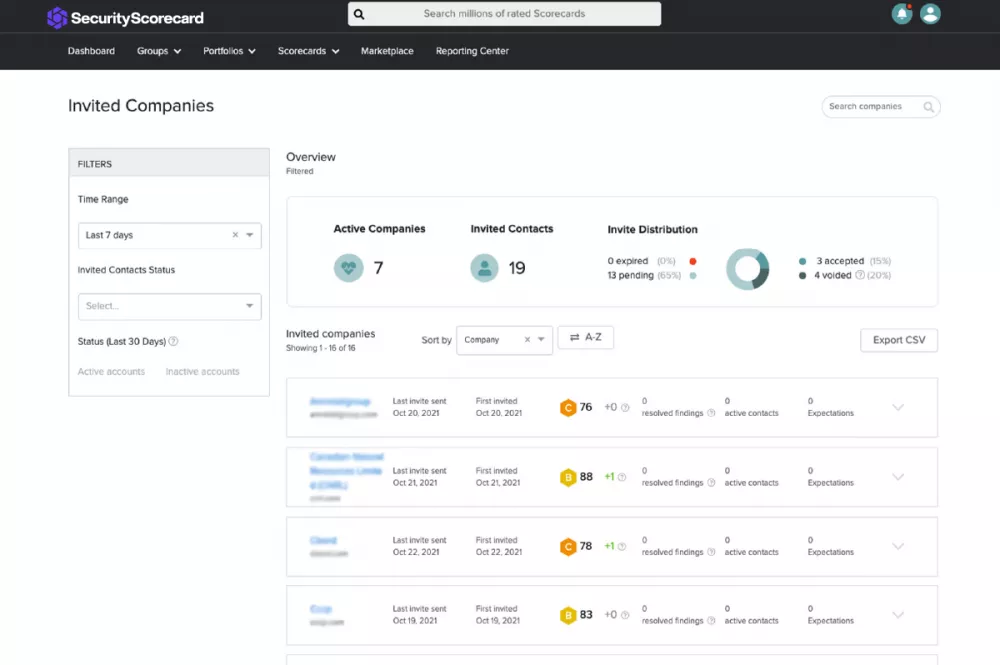

Scale third-party risk management, manage cost, and deliver more accurate results by automating the assessment cycle and validating results with objective external findings.

Maintain Cyber Hygiene

Regulatory breach notification reporting requires both incident response and digital forensics capabilities. Respond to a breach and mitigate its risk while being transparent with federal regulators.

“SecurityScorecard gives us a more objective and dynamic evaluation. We can now review vendors continuously and present results and key risk indicators monthly to Senior Management and our IT Risk Management Committee.”

Make informed decisions and build trust.

Vet the security posture of every service provider and identify common financial services cybersecurity issues. You can analyze risk trends across a group of organizations or portfolios to view aggregate risk and determine which vulnerabilities to focus on first.

Show your customers and investors that you’re following industry best practices to safeguard their financial information and mitigate regulatory risk. Continuously track regulatory adherence and detect potential gaps with current financial services security mandates such as ISO, SOX, PCI, DSS, and GDPR.

Communicate cyber risk in a language that business leaders with or without technical expertise can easily understand so executives and boards can view risk trends across their investment portfolios. Automatically pull high-level reports or offer more detail around individual risk factors such as application security, network security, and more.

Drive growth through acquisition without compromising on security. Before you merge or acquire, investigate your M&A target’s security posture to avoid taking on undue risk through legacy systems or other vulnerabilities.

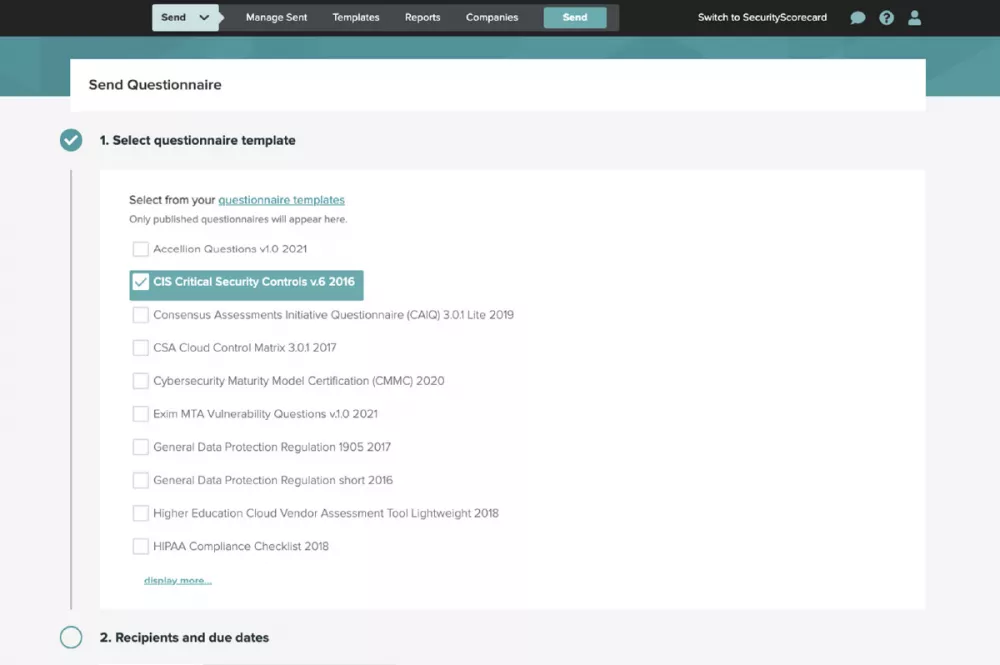

Eliminate the need for manual exchange of financial services compliance questionnaires via Excel spreadsheets. By automatically deploying and validating SecurityScorecard Assessments, you can reduce the time spent on security questionnaires by 83%.

How Can We Help?

Whether you’re ready to speak someone about pricing, want to dive deeper on a specific topic,

or have a problem that you’re not sure we can address, we’ll contact you with someone who can help.

Head Office

1005 Metropolitan Ave, Corner Kakarong, Makati, 1205 Metro Manila

Cebu Office

2F Unit 202-204, GMC Innovation Center, M. J. Cuenco Ave, Brgy San Roque Cebu City 6000

Davao Office

Unit 11, Plug Holdings Bldg, 141 R. Castillo St, Agdao, Davao City, 8000 Davao del Sur